- Predict if a customer will or will not default

- Important features

- Debt to income ratio: The reason this may be an important feature in deciding whether a user will default or not because the more debt and less income a person has, the less chance that they will be able to pay back a loan

- Delinquent credit lines: This may be an important feature because it shows that the persons payments are way past due, it shows that they are not able to pay back their credit cards and therefore may have a hard time paying back a loan

-

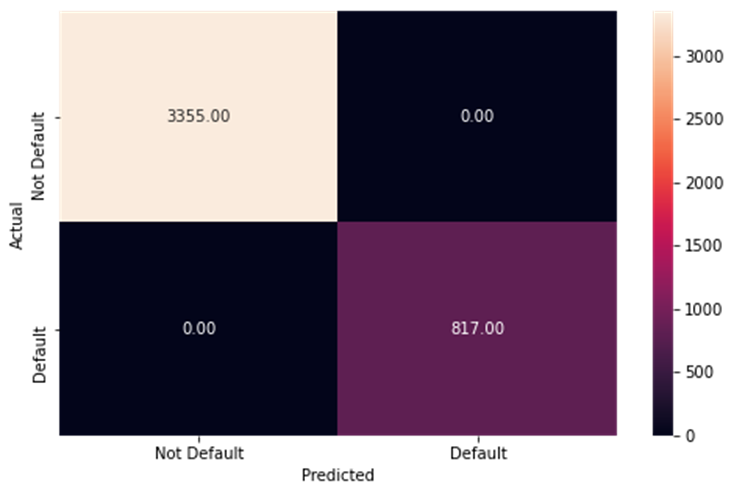

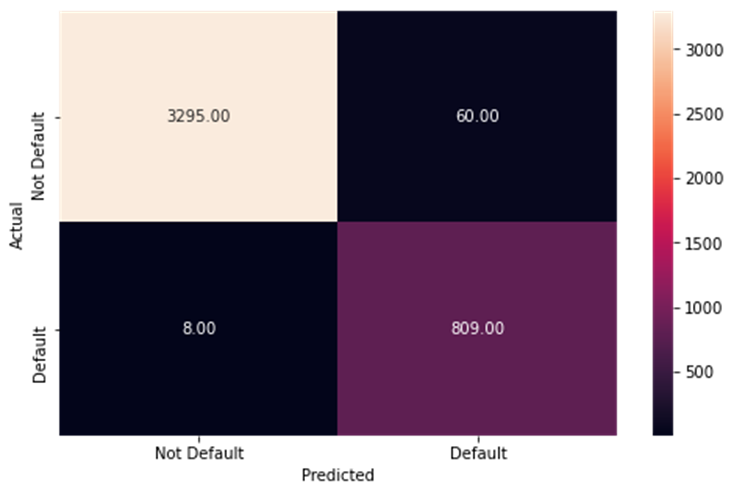

The training data performance for the final random forest tuned model

-

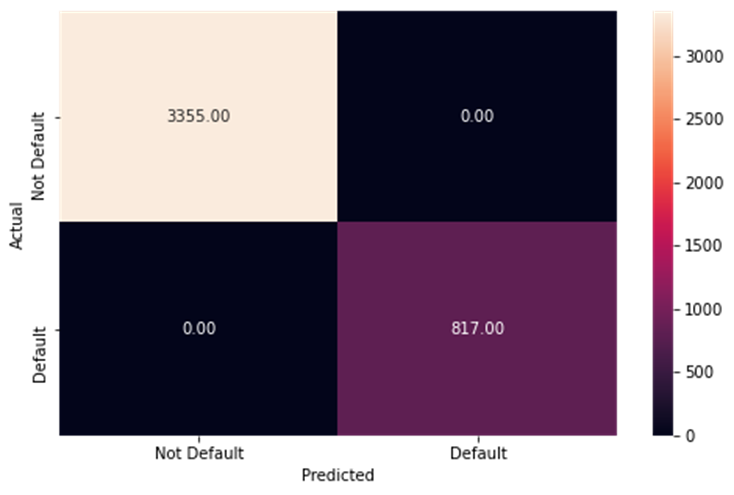

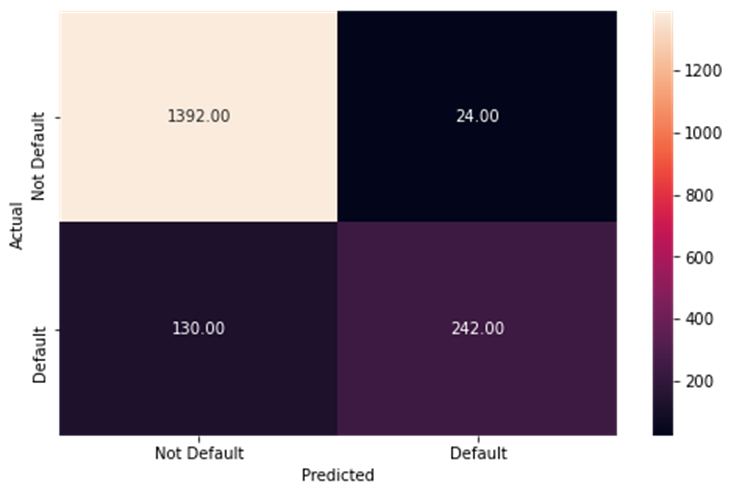

The test data performance for the final random forest tuned model

-

As you can see, the untuned models on training data have perfect performance, meaning they are overfit, which leads to worse performance on test data

-

To fix this I tuned the data, which equalized the performance and made it so it could work on more varied data

-

The models used were decision tree and random forest

-

Decision tree was faster but random forest was better at classifying

-

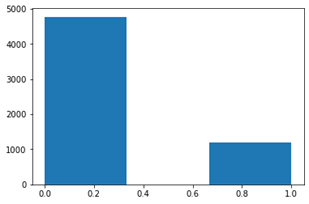

The graph below shows the data imbalance between loans that were paid back, and loans that were defaulted.

-

We can see that there is a severe imbalance.

-

In the future tuning we may want to fix this.

-

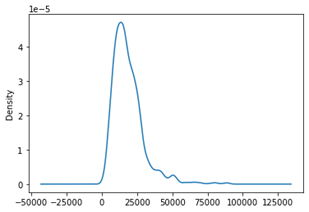

The graph to the right is a density plot of the loan amounts.

-

We can see that most of the loans lie around the $20,000 mark.

-

This is important because it shows what the risk of getting a prediction wrong is.

-

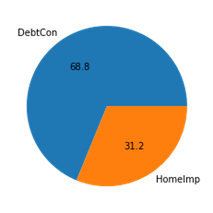

This graph shows the amount of loans that are for debt consolidation versus the loans that are taken for home improvement.

-

This tells us that there are many more people who are getting a loan for debt, rather than for home improvement.

# Libraries we need

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.preprocessing import StandardScaler

from sklearn.model_selection import train_test_split

from sklearn.discriminant_analysis import LinearDiscriminantAnalysis

from sklearn.discriminant_analysis import QuadraticDiscriminantAnalysis

from sklearn.linear_model import LogisticRegression

from sklearn.neighbors import KNeighborsClassifier

from sklearn import metrics

from sklearn.metrics import confusion_matrix, classification_report, precision_recall_curve,recall_score

from sklearn import tree

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import BaggingClassifier

from sklearn.ensemble import RandomForestClassifier

from sklearn.model_selection import GridSearchCVdf = pd.read_csv("Dataset.csv")df.head().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| BAD | LOAN | MORTDUE | VALUE | REASON | JOB | YOJ | DEROG | DELINQ | CLAGE | NINQ | CLNO | DEBTINC | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 1100 | 25860.0 | 39025.0 | HomeImp | Other | 10.5 | 0.0 | 0.0 | 94.366667 | 1.0 | 9.0 | NaN |

| 1 | 1 | 1300 | 70053.0 | 68400.0 | HomeImp | Other | 7.0 | 0.0 | 2.0 | 121.833333 | 0.0 | 14.0 | NaN |

| 2 | 1 | 1500 | 13500.0 | 16700.0 | HomeImp | Other | 4.0 | 0.0 | 0.0 | 149.466667 | 1.0 | 10.0 | NaN |

| 3 | 1 | 1500 | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN | NaN |

| 4 | 0 | 1700 | 97800.0 | 112000.0 | HomeImp | Office | 3.0 | 0.0 | 0.0 | 93.333333 | 0.0 | 14.0 | NaN |

df.info()<class 'pandas.core.frame.DataFrame'>

RangeIndex: 5960 entries, 0 to 5959

Data columns (total 13 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 BAD 5960 non-null int64

1 LOAN 5960 non-null int64

2 MORTDUE 5442 non-null float64

3 VALUE 5848 non-null float64

4 REASON 5708 non-null object

5 JOB 5681 non-null object

6 YOJ 5445 non-null float64

7 DEROG 5252 non-null float64

8 DELINQ 5380 non-null float64

9 CLAGE 5652 non-null float64

10 NINQ 5450 non-null float64

11 CLNO 5738 non-null float64

12 DEBTINC 4693 non-null float64

dtypes: float64(9), int64(2), object(2)

memory usage: 605.4+ KB

df.nunique()BAD 2

LOAN 540

MORTDUE 5053

VALUE 5381

REASON 2

JOB 6

YOJ 99

DEROG 11

DELINQ 14

CLAGE 5314

NINQ 16

CLNO 62

DEBTINC 4693

dtype: int64

- Above we can see that Reason and Bad are binary variables

- Nothing needs to be dropped

df.describe().dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| BAD | LOAN | MORTDUE | VALUE | YOJ | DEROG | DELINQ | CLAGE | NINQ | CLNO | DEBTINC | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 5960.000000 | 5960.000000 | 5442.000000 | 5848.000000 | 5445.000000 | 5252.000000 | 5380.000000 | 5652.000000 | 5450.000000 | 5738.000000 | 4693.000000 |

| mean | 0.199497 | 18607.969799 | 73760.817200 | 101776.048741 | 8.922268 | 0.254570 | 0.449442 | 179.766275 | 1.186055 | 21.296096 | 33.779915 |

| std | 0.399656 | 11207.480417 | 44457.609458 | 57385.775334 | 7.573982 | 0.846047 | 1.127266 | 85.810092 | 1.728675 | 10.138933 | 8.601746 |

| min | 0.000000 | 1100.000000 | 2063.000000 | 8000.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.000000 | 0.524499 |

| 25% | 0.000000 | 11100.000000 | 46276.000000 | 66075.500000 | 3.000000 | 0.000000 | 0.000000 | 115.116702 | 0.000000 | 15.000000 | 29.140031 |

| 50% | 0.000000 | 16300.000000 | 65019.000000 | 89235.500000 | 7.000000 | 0.000000 | 0.000000 | 173.466667 | 1.000000 | 20.000000 | 34.818262 |

| 75% | 0.000000 | 23300.000000 | 91488.000000 | 119824.250000 | 13.000000 | 0.000000 | 0.000000 | 231.562278 | 2.000000 | 26.000000 | 39.003141 |

| max | 1.000000 | 89900.000000 | 399550.000000 | 855909.000000 | 41.000000 | 10.000000 | 15.000000 | 1168.233561 | 17.000000 | 71.000000 | 203.312149 |

plt.hist(df['BAD'], bins=3)

plt.show()df['LOAN'].plot(kind='density')

plt.show()plt.pie(df['REASON'].value_counts(), labels=['DebtCon', 'HomeImp'], autopct='%.1f')

plt.show()

df['REASON'].value_counts()DebtCon 3928

HomeImp 1780

Name: REASON, dtype: int64

correlation = df.corr()

sns.heatmap(correlation)

plt.show()df['BAD'].value_counts(normalize=True)0 0.800503

1 0.199497

Name: BAD, dtype: float64

df.fillna(df.mean(), inplace=True)one_hot_encoding = pd.get_dummies(df['REASON'])

df = df.drop('REASON', axis=1)

df = df.join(one_hot_encoding)

df.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| BAD | LOAN | MORTDUE | VALUE | JOB | YOJ | DEROG | DELINQ | CLAGE | NINQ | CLNO | DEBTINC | DebtCon | HomeImp | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 1100 | 25860.0000 | 39025.000000 | Other | 10.500000 | 0.00000 | 0.000000 | 94.366667 | 1.000000 | 9.000000 | 33.779915 | 0 | 1 |

| 1 | 1 | 1300 | 70053.0000 | 68400.000000 | Other | 7.000000 | 0.00000 | 2.000000 | 121.833333 | 0.000000 | 14.000000 | 33.779915 | 0 | 1 |

| 2 | 1 | 1500 | 13500.0000 | 16700.000000 | Other | 4.000000 | 0.00000 | 0.000000 | 149.466667 | 1.000000 | 10.000000 | 33.779915 | 0 | 1 |

| 3 | 1 | 1500 | 73760.8172 | 101776.048741 | NaN | 8.922268 | 0.25457 | 0.449442 | 179.766275 | 1.186055 | 21.296096 | 33.779915 | 0 | 0 |

| 4 | 0 | 1700 | 97800.0000 | 112000.000000 | Office | 3.000000 | 0.00000 | 0.000000 | 93.333333 | 0.000000 | 14.000000 | 33.779915 | 0 | 1 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 5955 | 0 | 88900 | 57264.0000 | 90185.000000 | Other | 16.000000 | 0.00000 | 0.000000 | 221.808718 | 0.000000 | 16.000000 | 36.112347 | 1 | 0 |

| 5956 | 0 | 89000 | 54576.0000 | 92937.000000 | Other | 16.000000 | 0.00000 | 0.000000 | 208.692070 | 0.000000 | 15.000000 | 35.859971 | 1 | 0 |

| 5957 | 0 | 89200 | 54045.0000 | 92924.000000 | Other | 15.000000 | 0.00000 | 0.000000 | 212.279697 | 0.000000 | 15.000000 | 35.556590 | 1 | 0 |

| 5958 | 0 | 89800 | 50370.0000 | 91861.000000 | Other | 14.000000 | 0.00000 | 0.000000 | 213.892709 | 0.000000 | 16.000000 | 34.340882 | 1 | 0 |

| 5959 | 0 | 89900 | 48811.0000 | 88934.000000 | Other | 15.000000 | 0.00000 | 0.000000 | 219.601002 | 0.000000 | 16.000000 | 34.571519 | 1 | 0 |

5960 rows × 14 columns

one_hot_encoding2 = pd.get_dummies(df['JOB'])

df = df.drop('JOB', axis=1)

df = df.join(one_hot_encoding2)

df.dataframe tbody tr th {

vertical-align: top;

}

.dataframe thead th {

text-align: right;

}

| BAD | LOAN | MORTDUE | VALUE | YOJ | DEROG | DELINQ | CLAGE | NINQ | CLNO | DEBTINC | DebtCon | HomeImp | Mgr | Office | Other | ProfExe | Sales | Self | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 1100 | 25860.0000 | 39025.000000 | 10.500000 | 0.00000 | 0.000000 | 94.366667 | 1.000000 | 9.000000 | 33.779915 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 |

| 1 | 1 | 1300 | 70053.0000 | 68400.000000 | 7.000000 | 0.00000 | 2.000000 | 121.833333 | 0.000000 | 14.000000 | 33.779915 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 |

| 2 | 1 | 1500 | 13500.0000 | 16700.000000 | 4.000000 | 0.00000 | 0.000000 | 149.466667 | 1.000000 | 10.000000 | 33.779915 | 0 | 1 | 0 | 0 | 1 | 0 | 0 | 0 |

| 3 | 1 | 1500 | 73760.8172 | 101776.048741 | 8.922268 | 0.25457 | 0.449442 | 179.766275 | 1.186055 | 21.296096 | 33.779915 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 4 | 0 | 1700 | 97800.0000 | 112000.000000 | 3.000000 | 0.00000 | 0.000000 | 93.333333 | 0.000000 | 14.000000 | 33.779915 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 0 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 5955 | 0 | 88900 | 57264.0000 | 90185.000000 | 16.000000 | 0.00000 | 0.000000 | 221.808718 | 0.000000 | 16.000000 | 36.112347 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 5956 | 0 | 89000 | 54576.0000 | 92937.000000 | 16.000000 | 0.00000 | 0.000000 | 208.692070 | 0.000000 | 15.000000 | 35.859971 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 5957 | 0 | 89200 | 54045.0000 | 92924.000000 | 15.000000 | 0.00000 | 0.000000 | 212.279697 | 0.000000 | 15.000000 | 35.556590 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 5958 | 0 | 89800 | 50370.0000 | 91861.000000 | 14.000000 | 0.00000 | 0.000000 | 213.892709 | 0.000000 | 16.000000 | 34.340882 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

| 5959 | 0 | 89900 | 48811.0000 | 88934.000000 | 15.000000 | 0.00000 | 0.000000 | 219.601002 | 0.000000 | 16.000000 | 34.571519 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 0 |

5960 rows × 19 columns

dependent = df['BAD']

independent = df.drop(['BAD'], axis=1)

x_train, x_test, y_train, y_test = train_test_split(independent, dependent, test_size=0.3, random_state=1)def metrics_score(actual, predicted):

print(classification_report(actual, predicted))

cm = confusion_matrix(actual, predicted)

plt.figure(figsize=(8,5))

sns.heatmap(cm, annot=True, fmt='.2f', xticklabels=['Not Default', 'Default'], yticklabels=['Not Default', 'Default'])

plt.ylabel('Actual')

plt.xlabel('Predicted')

plt.show()dtree = DecisionTreeClassifier(class_weight={0:0.20, 1:0.80}, random_state=1)dtree.fit(x_train, y_train)DecisionTreeClassifier(class_weight={0: 0.2, 1: 0.8}, random_state=1)

dependent_performance_dt = dtree.predict(x_train)

metrics_score(y_train, dependent_performance_dt) precision recall f1-score support

0 1.00 1.00 1.00 3355

1 1.00 1.00 1.00 817

accuracy 1.00 4172

macro avg 1.00 1.00 1.00 4172

weighted avg 1.00 1.00 1.00 4172

- The above is perfect because we are using the train values, not the test

- Lets test on test data

dependent_test_performance_dt = dtree.predict(x_test)

metrics_score(y_test,dependent_test_performance_dt) precision recall f1-score support

0 0.90 0.92 0.91 1416

1 0.68 0.61 0.64 372

accuracy 0.86 1788

macro avg 0.79 0.77 0.78 1788

weighted avg 0.85 0.86 0.86 1788

- As we can see, we got decent performance from this model, lets see if we can do better

- Selfnote: do importance features next

important = dtree.feature_importances_

columns = independent.columns

important_items_df = pd.DataFrame(important, index=columns, columns=['Importance']).sort_values(by='Importance', ascending=False)

plt.figure(figsize=(13,13))

sns.barplot(important_items_df.Importance, important_items_df.index)

plt.show()C:\ProgramData\Anaconda3\lib\site-packages\seaborn\_decorators.py:36: FutureWarning: Pass the following variables as keyword args: x, y. From version 0.12, the only valid positional argument will be `data`, and passing other arguments without an explicit keyword will result in an error or misinterpretation.

warnings.warn(

- I followed this from a previous project to see the most important features

- We can see that the most important features are DEBTINC, CLAGE and CLNO

tree_estimator = DecisionTreeClassifier(class_weight={0:0.20, 1:0.80}, random_state=1)

parameters = {

'max_depth':np.arange(2,7),

'criterion':['gini', 'entropy'],

'min_samples_leaf':[5,10,20,25]

}

score = metrics.make_scorer(recall_score, pos_label=1)

gridCV= GridSearchCV(tree_estimator, parameters, scoring=score,cv=10)

gridCV = gridCV.fit(x_train, y_train)

tree_estimator = gridCV.best_estimator_

tree_estimator.fit(x_train, y_train)DecisionTreeClassifier(class_weight={0: 0.2, 1: 0.8}, max_depth=6,

min_samples_leaf=25, random_state=1)

dependent_performance_dt = tree_estimator.predict(x_train)

metrics_score(y_train, dependent_performance_dt) precision recall f1-score support

0 0.95 0.87 0.91 3355

1 0.60 0.82 0.69 817

accuracy 0.86 4172

macro avg 0.77 0.84 0.80 4172

weighted avg 0.88 0.86 0.86 4172

- We increased the less harmful error but decreased the harmful error

dependent_test_performance_dt = tree_estimator.predict(x_test)

metrics_score(y_test, dependent_test_performance_dt) precision recall f1-score support

0 0.94 0.86 0.90 1416

1 0.60 0.77 0.67 372

accuracy 0.84 1788

macro avg 0.77 0.82 0.79 1788

weighted avg 0.87 0.84 0.85 1788

- Although the performance is slightly worse, we still reduce harmful error

important = tree_estimator.feature_importances_

columns=independent.columns

importance_df=pd.DataFrame(important,index=columns,columns=['Importance']).sort_values(by='Importance',ascending=False)

plt.figure(figsize=(13,13))

sns.barplot(importance_df.Importance,importance_df.index)

plt.show()C:\ProgramData\Anaconda3\lib\site-packages\seaborn\_decorators.py:36: FutureWarning: Pass the following variables as keyword args: x, y. From version 0.12, the only valid positional argument will be `data`, and passing other arguments without an explicit keyword will result in an error or misinterpretation.

warnings.warn(

features = list(independent.columns)

plt.figure(figsize=(30,20))

tree.plot_tree(dtree,max_depth=4,feature_names=features,filled=True,fontsize=12,node_ids=True,class_names=True)

plt.show()- A visualization is one of the advantages that dtrees offer, we can show this to the client ot show the thought process

forest_estimator = RandomForestClassifier(class_weight={0:0.20, 1:0.80}, random_state=1)

forest_estimator.fit(x_train, y_train)RandomForestClassifier(class_weight={0: 0.2, 1: 0.8}, random_state=1)

y_predict_training_forest = forest_estimator.predict(x_train)

metrics_score(y_train, y_predict_training_forest) precision recall f1-score support

0 1.00 1.00 1.00 3355

1 1.00 1.00 1.00 817

accuracy 1.00 4172

macro avg 1.00 1.00 1.00 4172

weighted avg 1.00 1.00 1.00 4172

- A perfect classification

- This implies overfitting

y_predict_test_forest = forest_estimator.predict(x_test)

metrics_score(y_test, y_predict_test_forest) precision recall f1-score support

0 0.91 0.98 0.95 1416

1 0.91 0.65 0.76 372

accuracy 0.91 1788

macro avg 0.91 0.82 0.85 1788

weighted avg 0.91 0.91 0.91 1788

- The performance is a lot better than the original single tree

- Lets fix overfitting

forest_estimator_tuned = RandomForestClassifier(class_weight={0:0.20,1:0.80}, random_state=1)

parameters_rf = {

"n_estimators": [100,250,500],

"min_samples_leaf": np.arange(1, 4,1),

"max_features": [0.7,0.9,'auto'],

}

score = metrics.make_scorer(recall_score, pos_label=1)

# Run the grid search

grid_obj = GridSearchCV(forest_estimator_tuned, parameters_rf, scoring=score, cv=5)

grid_obj = grid_obj.fit(x_train, y_train)

# Set the clf to the best combination of parameters

forest_estimator_tuned = grid_obj.best_estimator_forest_estimator_tuned.fit(x_train, y_train)RandomForestClassifier(class_weight={0: 0.2, 1: 0.8}, min_samples_leaf=3,

n_estimators=500, random_state=1)

y_predict_train_forest_tuned = forest_estimator_tuned.predict(x_train)

metrics_score(y_train, y_predict_train_forest_tuned) precision recall f1-score support

0 1.00 0.98 0.99 3355

1 0.93 0.99 0.96 817

accuracy 0.98 4172

macro avg 0.96 0.99 0.97 4172

weighted avg 0.98 0.98 0.98 4172

y_predict_test_forest_tuned = forest_estimator_tuned.predict(x_test)

metrics_score(y_test, y_predict_test_forest_tuned) precision recall f1-score support

0 0.94 0.96 0.95 1416

1 0.83 0.75 0.79 372

accuracy 0.92 1788

macro avg 0.88 0.86 0.87 1788

weighted avg 0.91 0.92 0.92 1788

- We now have very good performance

- We can submit this to the company

- I made many models to get the best results.

- The first one I made was a decision tree, this is not as good as random forest but it is transparent as it lets us visualize it. This first one had decent performance.

- To improve the performance of this we tried to tune the model, this reduced the harmful error.

- Then to improve even more I created a decision tree model, this had excellent performance once we created a second version which removed overfitting.

- The biggest thing that effects defaulting on a loan is the debt to income ratio. If someone has a lot of debt and a lower income they may have a harder time paying back a loan.

- Something else that effects defaulting on a loan is the number of delinquent credit lines. This means that someone who cannot make their credit card payments will have a hard time paying back a loan.

- Years at job is also a driver of a loans outcome. A large number of years at a job could indicate financial stability.

- DEROG, or a history of delinquent payments is also a warning sign of not being able to pay back a loan.

- Those are some warning signs/good signs that should be looked out for when looking for candidates to give loans to.

I will now apply SHAP to look more into this model.

!pip install shap

import shapRequirement already satisfied: shap in c:\programdata\anaconda3\lib\site-packages (0.39.0)

Requirement already satisfied: scipy in c:\programdata\anaconda3\lib\site-packages (from shap) (1.6.2)

Requirement already satisfied: numpy in c:\programdata\anaconda3\lib\site-packages (from shap) (1.20.1)

Requirement already satisfied: numba in c:\programdata\anaconda3\lib\site-packages (from shap) (0.53.1)

Requirement already satisfied: slicer==0.0.7 in c:\programdata\anaconda3\lib\site-packages (from shap) (0.0.7)

Requirement already satisfied: cloudpickle in c:\programdata\anaconda3\lib\site-packages (from shap) (1.6.0)

Requirement already satisfied: pandas in c:\programdata\anaconda3\lib\site-packages (from shap) (1.2.4)

Requirement already satisfied: scikit-learn in c:\programdata\anaconda3\lib\site-packages (from shap) (0.24.1)

Requirement already satisfied: tqdm>4.25.0 in c:\programdata\anaconda3\lib\site-packages (from shap) (4.59.0)

Requirement already satisfied: setuptools in c:\programdata\anaconda3\lib\site-packages (from numba->shap) (52.0.0.post20210125)

Requirement already satisfied: llvmlite<0.37,>=0.36.0rc1 in c:\programdata\anaconda3\lib\site-packages (from numba->shap) (0.36.0)

Requirement already satisfied: pytz>=2017.3 in c:\programdata\anaconda3\lib\site-packages (from pandas->shap) (2021.1)

Requirement already satisfied: python-dateutil>=2.7.3 in c:\programdata\anaconda3\lib\site-packages (from pandas->shap) (2.8.1)

Requirement already satisfied: six>=1.5 in c:\programdata\anaconda3\lib\site-packages (from python-dateutil>=2.7.3->pandas->shap) (1.15.0)

Requirement already satisfied: joblib>=0.11 in c:\programdata\anaconda3\lib\site-packages (from scikit-learn->shap) (1.0.1)

Requirement already satisfied: threadpoolctl>=2.0.0 in c:\programdata\anaconda3\lib\site-packages (from scikit-learn->shap) (2.1.0)

shap.initjs()explain = shap.TreeExplainer(forest_estimator_tuned)

shap_vals = explain(x_train)type(shap_vals)shap._explanation.Explanation

shap.plots.bar(shap_vals[:, :, 0])shap.plots.heatmap(shap_vals[:, :, 0])shap.summary_plot(shap_vals[:, :, 0], x_train)print(forest_estimator_tuned.predict(x_test.iloc[107].to_numpy().reshape(1,-1))) # This predicts for one row, 0 means approved, 1 means no.[1]