Name

Super-Scalper-5-Min-15-Min

Author

ChaoZhang

Strategy Description

This strategy is based on RSI and ATR Bands which works better in 5 and 15 Mins time frame. Perform enough back testing with 1:2R before using in real time.

Entry only on trade on screen symbols, use additional buy/sell alerts to book profit or to trail SL.

I have also added Golden Cross Over of 65 and 21 EMA to have confirmation on trend.

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 14 | ATR Period |

| v_input_float_1 | true | ATR Multi |

| v_input_string_1 | 0 | ATR Smoothing: WMA |

| v_input_int_2 | 21 | Fast EMA |

| v_input_int_3 | 65 | Slow EMA |

| v_input_int_4 | 25 | Fast RSI Length |

| v_input_int_5 | 100 | Slow RSI Length |

Source (PineScript)

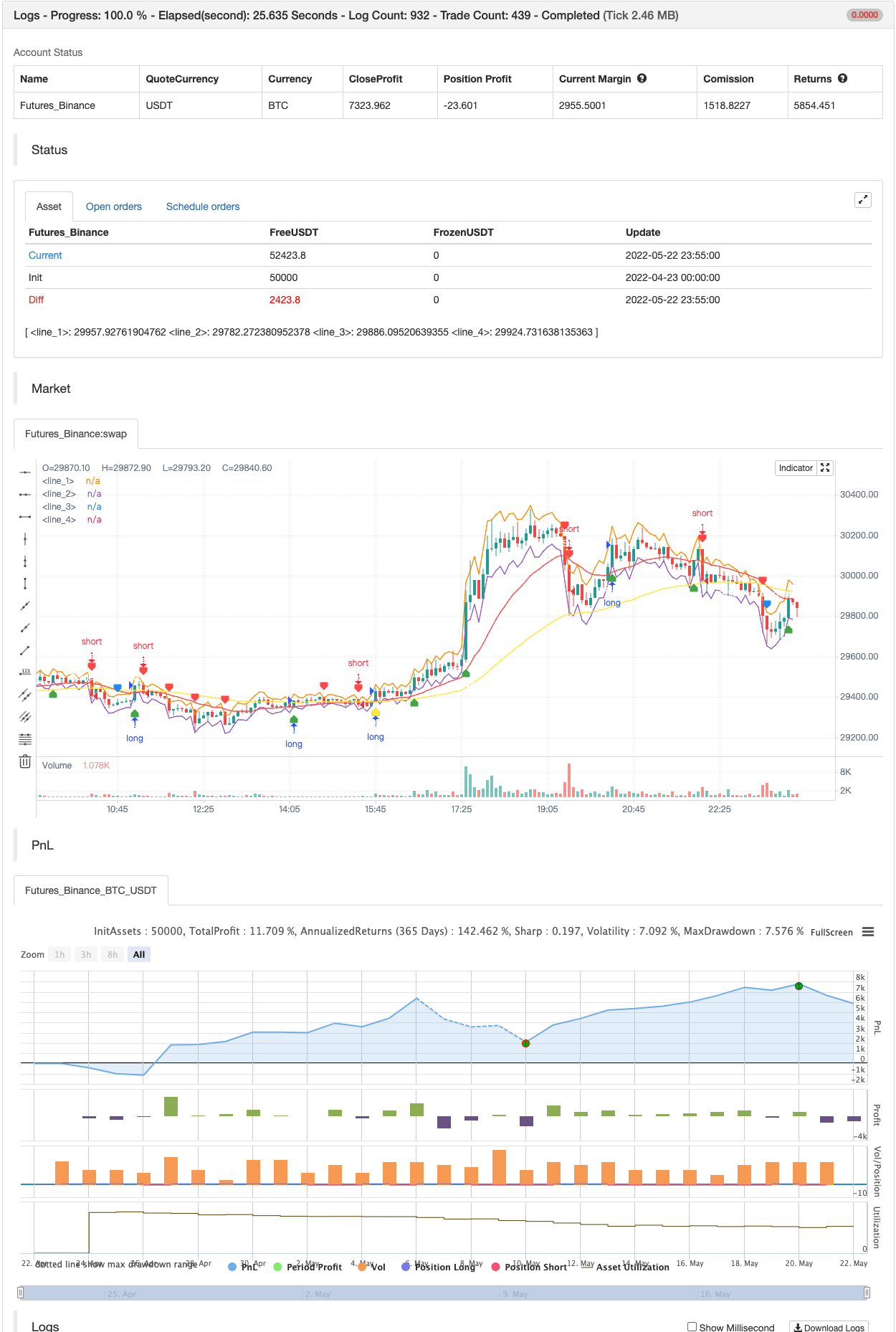

/*backtest

start: 2022-04-23 00:00:00

end: 2022-05-22 23:59:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Revision: Updated script to pine script version 5

//added Double RSI for Long/Short prosition trend confirmation instead of single RSI

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

source = close

atrlen = input.int(14, "ATR Period")

mult = input.float(1, "ATR Multi", step=0.1)

smoothing = input.string(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

ta.rma(source, atrlen)

else

if smoothing == "SMA"

ta.sma(source, atrlen)

else

if smoothing == "EMA"

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

// Create Indicator's

ShortEMAlen = input.int(21, "Fast EMA")

LongEMAlen = input.int(65, "Slow EMA")

shortSMA = ta.ema(close, ShortEMAlen)

longSMA = ta.ema(close, LongEMAlen)

RSILen1 = input.int(25, "Fast RSI Length")

RSILen2 = input.int(100, "Slow RSI Length")

rsi1 = ta.rsi(close, RSILen1)

rsi2 = ta.rsi(close, RSILen2)

atr = ta.atr(atrlen)

//RSI Cross condition

RSILong = rsi1 > rsi2

RSIShort = rsi1 < rsi2

// Specify conditions

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = ta.crossover(shortSMA,longSMA)

Goldenshort = ta.crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, when = RSILong)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, when = RSIShort)

// Plot ATR bands to chart

////ATR Up/Low Bands

plot(upper_band)

plot(lower_band)

// Plot Moving Averages

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)

Detail

https://www.fmz.com/strategy/365373

Last Modified

2022-05-24 16:20:58